These are hard times:

it's time for

Soft Mergers.

If the words 'Mergers & Acquisitions'...

If the words 'Mergers & Acquisitions'...

If the words 'Mergers & Acquisitions'...

make you think of armies of lawyers

If the words 'Mergers & Acquisitions'...

make you think of armies of lawyers

and snot-nosed MBAs : ), think again...

If the words 'Mergers & Acquisitions'...

make you think of armies of lawyers

and snot-nosed MBAs : ),

think again...

There's a new type of merger on the horizon...

There's a new type of merger on the horizon...

It's called the soft merger.

There's a new type of merger on the horizon...

It's called the soft merger

(or the mellow merger).

And in these hard times,

And in these hard times,

a soft merger

And in these hard times,

a soft merger may just be

And in these hard times,

a soft merger may just be

what your business needs

And in these hard times,

a soft merger may just be

what your business needs to survive

And in these hard times,

a soft merger may just be

what your business needs to survive — and thrive.

These are tough times; it's time for Soft mergers.

Let the Wall Street crowd deal with their expensive, messy mergers.

There's a newer, smarter way to do business.

And if If you're running

a tech startup,

a wine shop,

an accounting firm,

a dry cleaner,

a clean energy fund,

a solo business,

a brewery,

a temp agency,

an engineering firm,

a medical office,

a nonprofit,

a biotech startup,

a BBQ joint,

a university,

anything non-Crypto : ),

a lumberyard,

a venture capital firm,

a literary agency,

a gym,

a bookstore,

a truck stop,

a country... : )

a

soft merger can transform your strategy — right now.

a tech startup,

a wine shop,

an accounting firm,

a dry cleaner,

a clean energy fund,

a solo business,

a brewery,

a temp agency,

an engineering firm,

a medical office,

a nonprofit,

a biotech startup,

a BBQ joint,

a university,

anything non-Crypto : ),

a lumberyard,

a venture capital firm,

a literary agency,

a gym,

a bookstore,

a truck stop,

a country... : )

And if you ARE the Wall Street crowd, maybe you should try a different approach... like, say, (hint, hint) a soft merger?

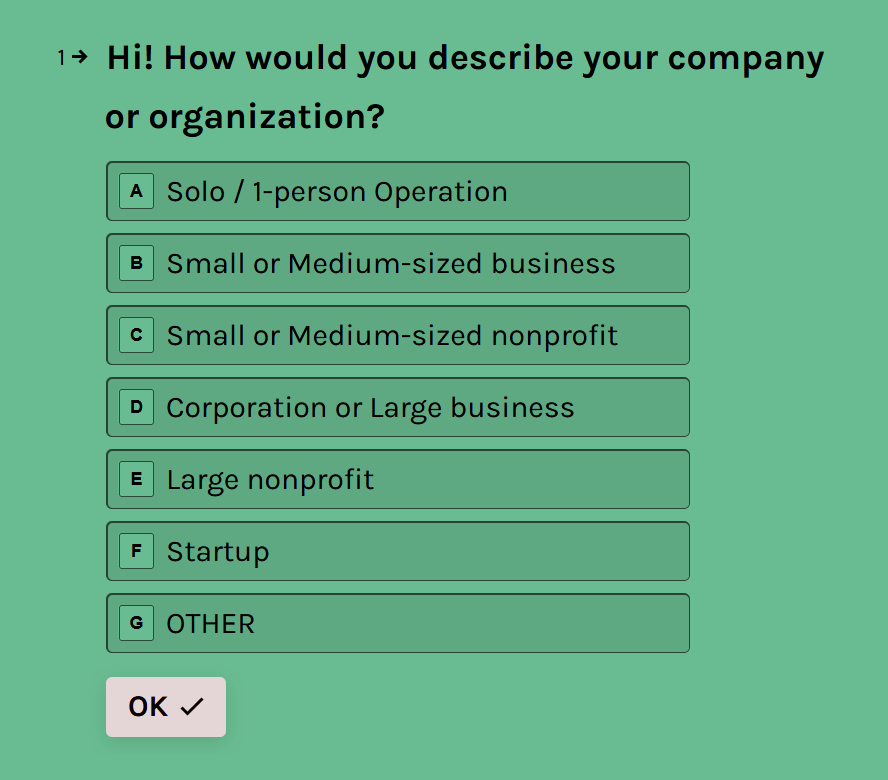

So, what IS a Soft merger?

So, what IS a Soft merger?

Call it

No names are changed, no money is exchanged,

A soft merger can be used by ANY type of business — not just big ones.

a partnership,

an alliance,

a coalition,

a joint venture

a soft merger — or mellow merger — is a:

flexible, short-term union between 2 or more companies.

no one's laid off, no executives leave in anger...

In a soft merger,

businesses partner with each other

to achieve a common goal, for a short period of time.

And when they're done?

They can just part ways cleanly — no lawyers needed (and no headaches, either : ).

What is a Soft merger?

Qu'est ce qu'une Fusion soft? —¿Qué es una Fusión 'soft'? — O que é uma Fusão 'soft'? —

What is a Soft merger?

Should you consider a Soft merger?

Should you consider a Soft merger?

Well, if you need a hand getting customers in the door,

generating new ideas, or

hiring top talent,

then a soft merger may be what you need.

If your company is already perfect, then God bless you.

The 5 Types of Soft Mergers

There are millions of potential partners you could soft-merge with, but just 5 types of soft mergers.

They are: HORIZONTAL, VERTICAL, GEOGRAPHIC, TRANSACTIONAL, and PROTECTIVE.

1. HORIZONTAL Soft Merger

Best for: Small & Medium businesses, Solo businesses, Businesses in creative industries as well as those in seemingly "boring" / commodities industries.

A Horizontal soft merger is one in which a business or organization partners with...

Click for more info

A Horizontal soft merger is one in which a business or organization partners with companies in the same sector as them — or in very similar sectors.Example:

Let's say that you run an architectural firm in Los Angeles, specialized in public centers – museums, concert halls, convention centers, etc.

A Horizontal soft merger might involve partnering with:

- a similar architectural firm, but in a different location – say, Mexico City

- a different architectural firm in L.A., but one that does residential projects

- a New York-based interior designer who works on architectural projects around the world.

2. VERTICAL Soft Merger

Best for: Any business, but particularly those with small or specialised suppliers. Also well suited to businesses that worry about the vulnerablity of their supplier(s) or distributor(s).

A Vertical soft merger is one in which a business or organization partners with...

Click for more info

A Vertical soft merger is one in which a business or organization partners with another company that is part of its chain of activity.Take your production and break it down into steps. A vertical soft merger would be a partnership between you and any of the companies at the different steps of production.

Example:

Suppose you are a British fashion company that creates slippers and socks made from Yorkshire wool.

A Vertical soft merger might involve partnering with:

- the sheep farmer in North Yorkshire that produces the wool you use

- the family-operated factory in Cornwall that cleans and dyes the wool

- the West London boutique that sells your slippers to customers.

3. GEOGRAPHIC Soft Merger

[Coming soon]

Best for: Any business, but particularly those that are located in out-of-the-way or under-the-radar locations. Also suited to businesses & organizations in creative industries.

In a Geographic soft merger, a business or organization uses geography...

Click for more info

In a Geographic soft merger, a business or organization uses geography or location to determine who to partner with it.TIGHT Geographic mergers = partnering with nearby businesses

LOOSE Geographic mergers = partnering with faraway businesses

Example:

Let's say that you run a spa and nutrition center in Albania, outside the capital -- Tirana. Albania is a beautiful, and cheap, and right on the Mediterranean! But no one seems to know about your country. You want to change that.

In a TIGHT Geographic soft merger, you would partner with:

- a luxury hotel in Albania

- a yacht & boating company in Albania

- a VIP tour guide with expertise in the ABC countries (Albania, Bosnia, Croatia)

And all together, you would promote Albania and your companies — to attract customers to your business, and visitors to your country.

In a LOOSE Geographic soft merger, you would partner with:

- sports team in Europe and Africa

and encourage their players to visit your spa in Albania for rest, rehab & relaxation

4. TRANSACTIONAL Soft Merger

[Coming soon]

Best for: Any business in any industry, but particularly for smaller ones seeking better deals and greater negotiating power.

In a Transactional soft merger, companies or organizations partner together for a specific, usually short-term purpose...

.

Click for more info

In a Transactional soft merger, companies partner together for a specific, usually short-term purpose...Example:

Suppose you are the Director of a national art museum in Bamako, Mali – in West Africa.

There is a group of African sculptures being auctioned, some of them from Mali. You would love for them to be in your museum, and not end up in some private home, never to be seen again. But you don't have the millions needed to acquire the sculpture.

In a Transactional soft merger, you would partner with:

- a wealthy businesswoman from Bamako who is a patron of the arts

- a European agency that supports cultural initiatives

- a famous Malian soccer player who now lives in Dubai

Together, you would raise the funds for the art, and buy the sculptures for your museum.

As part of the arrangement, you may:

* name a new wing of the museum after the businesswoman,

* feature the soccer player in your brochures, and

* credit the European agency in the exhibition materials.

In a transactional soft merger, entities that wouldn't normally partner with each other decide to get together. And once their mission is achieved, they can break up the partnership.

5. PROTECTIVE Soft Merger

[Coming soon]

Best for: Businesses — of any size, in any industry — that are considering a traditional merger or acquisition; particularly for Startups in tech, biotech, & pharma that are being acquired.

A Protective soft merger is one in which a business or organization agrees to...

Click for more info

A Protective soft merger is one in which a business or organization agrees to a pre-merger or a temporary merger before the official merger.Example:

Suppose you run a small but very successful agricutural engineering firm in Iowa.

A major conglomerate has been trying to get you to join them. You have a very specific chemical process that you follow to make your fertilizers. You are not certain the big corporation will uphold the rigorous process.

You are also wondering if they're trying to get rid of you as a competitor.

In a Protective soft merger, you would:

- agree to a temporary partnership with the other company (12-18 months)

- outline the projects and products that you are currently engaged in

- obtain written agreement that the methods you are using will not be changed or weakened during a soft (or hard) merger

- negotiate a payment for the soft merger period — a payment that would be deducted from the acquisition price if all goes well, and the official merger takes place.

Teach me more about Soft Mergers

If you're ready to learn more about Soft Mergers IN GENERAL.

What you will get

If you are ready to implement a soft merger at your company or organization,

you should choose 1 of the Interactive sessions (see Help me choose; Help me decide).

Help me choose the Soft Merger I need

If you're considering a Soft Merger, but aren't sure about WHICH type.

What you will get

It should be booked for a company or organization ready to implement a soft merger.

If you simply want to learn more about Soft mergers, you should book an Information session (see Teach me more).

Help me decide who to Soft-merge with

If you're READY for a Soft Merger, but haven't decided with WHOM to merge. .

What you will get

It should be booked for a company or organization ready to implement a soft merger.

If you simply want to learn more about Soft mergers, you should book an Information session (see Teach me more).